If the provisions including in HF 290 and SF1635 become law, the legislature will effectively eliminate access to short-term unsecured state-regulated consumer credit in Minnesota, but the need for credit will not go away. Thousands of Minnesotans depend on consumer short-term lenders for short-term unsecured consumer credit.

What is the reality facing Americans today?

- 61% of Americans who’ve paid a bill late in the past six months say they didn’t have enough money to cover the cost. Women are more likely than men to cite this — 64% versus 57%.

- Nearly half of those who were late with a payment say it was a utility bill (46%), followed by a credit card (39%), or cable or internet bill (34%). Women cite utility bills as the main culprit (51%), while men say it’s credit card debt (42%).

- 51% of Americans have overdrawn their bank account to pay a bill, with 26% saying they’ve done it more than once. Of people who paid a bill late in the last 6 months, 72% paid a bank overdraft fee.

Proposed Payday Restrictions Will Harm Minnesotans

- Opponents of short-term lending would have you believe these unsecured loans have exorbitant fees. This is simply not true. The average Payday America (Minnesota’s largest lender) fee on a $500 loan is less than 7%.

- Today, a payday customer who is charged the maximum allowed under current MN law in fees and interest, pays $31.33 to borrow $500 for two weeks. Proponents of this legislation translate this to an APR of 163.36%.

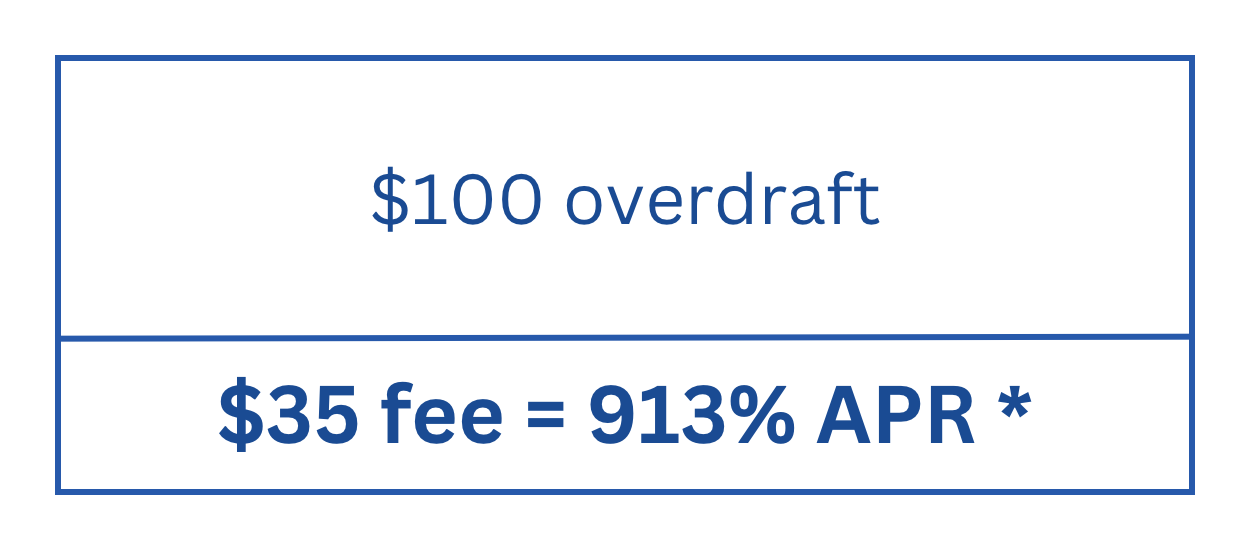

- Using the same calculation, other fees facing consumers generate even higher APR’s:

- The proposed legislation will force Minnesotans to outstate lenders who charge higher fees with little or no recourse.

- These payday lenders advance billions of dollars annually with APRs that exceed 600%.

- Minnesotans with short-term cash challenges need a place to turn. Negatively impacting the consumer finance marketplace eliminates regulated short-term credit solutions for thousands of working Minnesotans.

- Payday customers are middle-income Minnesotans (majority earning between $25,000 and $50,000), well educated (94% have a high school diploma or better and 56% have some college or degree), young families (68% are under 45 years old, a majority are married and 64% have children in the household), who are from the stable working class (42% own homes, 100% have steady incomes and checking accounts).

- Licensing requirements for Industrial Loan and Thrifts (unsecured lenders) are greater than those for a Consumer Small Loan Lender.

What happens when you pass an APR Cap?

- The supply of consumer credit is limited, and economic theory shows that an interest-rate cap, like any price ceiling, creates shortages, and gives rise to additional costs.

- Using credit bureau data, a report done in IL (a state that passed an APR cap) found that in the six months following the imposition of the 36 percent interest-rate cap created by the Illinois Predatory Loan Prevention Act, the average loan size for subprime borrowers in Illinois increased by roughly 40 percent.